According to an announcement from the index’s developers, Singapore’s new additions to the index include AIMS APAC REIT, ARA LOGOS Logistics Trust, Cromwell European REIT, ESR-REIT, Far East Hospitality Trust, Keppel Pacific Oak US REIT, Lendlease Global Commercial REIT, OUE Commercial REIT, Prime US REIT, SPH REIT, and Starhill Global REIT. The FTSE EPRA Nareit Global Developed Index could be a global index that monitors publicly traded REITs, assets holding and development companies. FTSE Russell collaborated with the ecu Public land Association (EPRA) and therefore the National Association of property Investment Trusts to form it (Nareit).

From the list of Reits included in the FTSE EPRA Nareit Global Developed Index, we select 3 and examine them. They are SPH REIT, Starhill Global REIT and Cromwell European REIT .

SPH REIT

Sphreit became bullish when it broke out of a triangle pattern 2 weeks ago. Since then, it rallied within a few days before falling back to its breakout point and going into sideways consolidation.

Based on the projection of the triangle breakout, the first price target is $0.98, which is 38% of the Fibonacci projection, and the second price target is $1.13, which is 100% of the Fibonacci projection.

The chart above shows that both price targets coincide with the longer-term resistance levels on the chart. This shows that the resistance levels are strong, and the price will likely correct when it reaches these levels.

When the price broke out of the downtrend 3 weeks ago, there was a golden cross on the indicators Elder Ray and Ehler Fisher Transform. As a result, the price rose 7.8%. The true breakout level was around $0.89, so it is not advisable to buy the stock now as the price is considered too high.

Moreover, the price has crossed the upper band of the STARC indicator, which means that the price is considered overbought. Therefore, traders should not chase the price now but better wait for a decline in the price. A trader interested in buying the stock should take a long position at or below $0.925.

This level is based on last Friday’s low and corresponds to the 38.2% Fibonacci retracement from the August low. Based on an entry price of $0.925 and a target price of $0.975, there is a potential return of 5%. This is a good return for the short-term trade.

Cromwell European land fund

The price of Cromwell Reits SGD broke through a new all-time high last Friday, September 3. From a chart perspective, this is a typical bullish scenario. Many traders like to buy on such a technical scenario as there are no significant resistance points.

However, from a technical indicator perspective, it is not advisable to chase the stock on such a breakout. As can be seen on the chart above, the stock formed a golden cross last Thursday, September 2, one bar before breaking through the all-time high.

This was an ideal time to buy as it was the earliest sign that the chart had turned up. On the same day, the Random Walk Index, Ehler Fisher Transform and Elder Ray indicators all showed the same golden cross at the same time. Although golden crosses are a sign of a bull market, it may be too late to buy now as the price is on the high side.

Based on the Fibonacci Zigzag projection technique, there are 2 possible scenarios of where the chart could go from here.

1.) Scenario 1: Price could continue to rally and make a new high between $4.21 and $4.28.

2.) Scenario 2: The price could initiate a pullback after reaching the first price target of $4.15. However, it could be risky to buy now as the price has risen more than 4% in 2 days. Traders looking to buy the stock now should wait for the price to retrace later before entering the trade.

So, it’s safer to buy around Friday’s low at $4.06. The stop loss should be placed at $3.96, and the price target is $4.21. This gives a risk reward ratio of 151%. This is a good starting point for the trade.

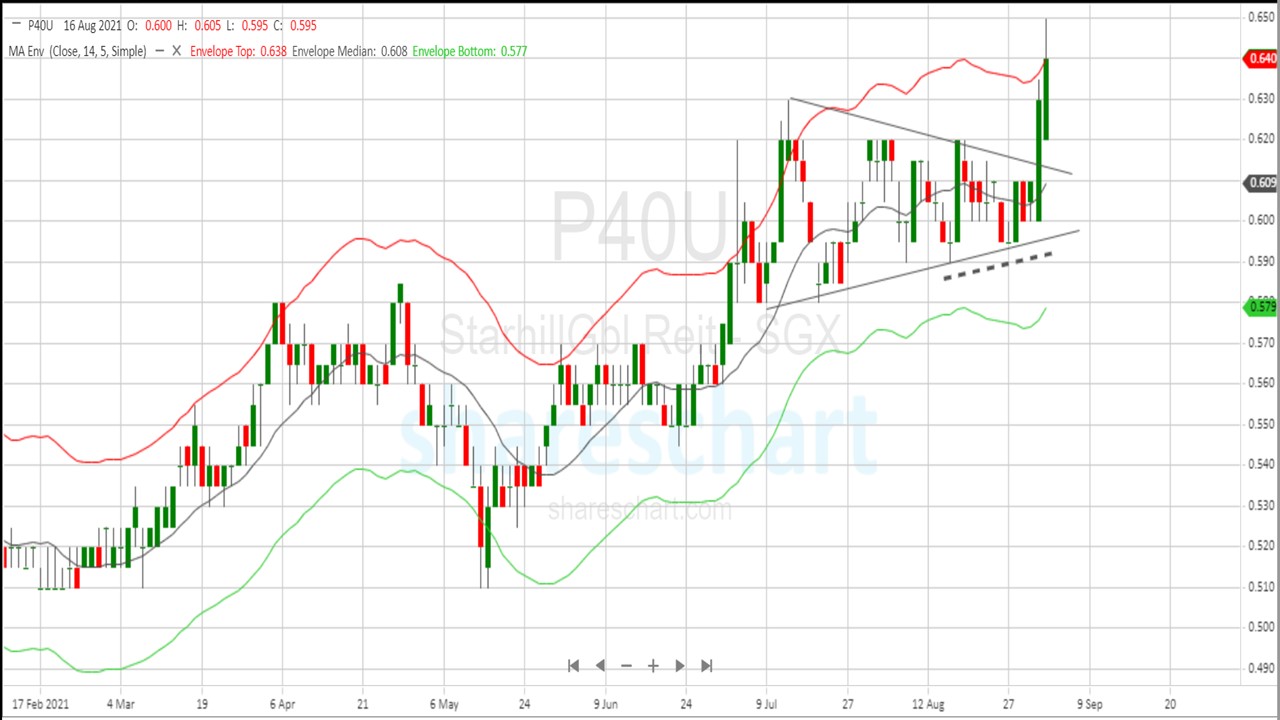

StarhillGBL Reits(SGX:P40U)

Last Thursday, September 2, Starhill’s share price broke out of a triangle pattern that had taken 2 weeks to form. That was when the news was released. The bullish divergence between the price and the stochastic just before the breakout from the triangle is a bullish sign that the breakout is likely to be sustained.

Unfortunately, the price action is too strong in the short term. In early April and mid-July, history has shown that price is likely to enter sideways consolidation once it reaches the upper band of the Envelope Indicator.

The Envelope indicator is one of the many technical indicators found in Shareshart.

Traders and investors use the Envelope indicator to identify extreme overbought and oversold positions and trading ranges.

The upper and lower bands of an envelope are usually created using a simple moving average and a predetermined distance above and below the moving average, but can also be created using a variety of other methods.

When the price reaches or exceeds the upper band of an envelope channel, many traders respond with a sell signal, and when the price reaches or exceeds the lower band, many traders respond with a buy signal.

Traders interested in buying this stock can take a long position if the price declines and consolidates over the next 2 weeks. A good entry level is around $0.63.

If a trader buys the stock at $0.63, the first price target can be set at $0.70, which is the 100% Fibonacci Projection basis of the triangle breakout method. If the stop loss is set at $0.58, the result is an attractive risk-reward ratio of 140%.

Short-term traders might even consider taking profits at $0.68, which equates to a 76% projection based on the triangle breakout method. Assuming the stop loss level remains the same, this has already resulted in a decent risk-reward ratio of 100%.

Let us take a bird’s eye view of Starhill stock. Starhill’s stock price plunged 50% in less than 3 months last January. Since then, Starhill had begun to form a typical double bottom, bottoming at $0.375 in March 2020 and $0.40 in November last year.

The price then recovered from the double bottom pattern as it broke out of 2 smaller triangle patterns. Triangle patterns usually take much shorter to form than a double bottom pattern.

The rise after breaking out of the triangle pattern is usually more explosive than a double bottom. In the textbook breakout scenario above, the probability of a price rise from the current level to the indicated target price is high.

Based on the double bottom breakout, the first price target is $0.695, which is the 50% Fibonacci projection level based on the double bottom breakout. As can be seen from the chart above, this point is also the long-term resistance level on the Starhill chart. This is the point where the price started to melt down in March last year.

In addition, this point coincided with the target for the breakout from the triangle at $0.70 mentioned in the previous paragraph. As mentioned earlier, this results in a good risk/reward ratio of 100%.

The second price target is $0.80, based on the 100% Fibonacci projection level of the double bottom breakout. It is possible that this level can be reached based on the technical analysis conditions, but it takes time.

We would also like to analyze the chart from a different perspective to improve our earlier view. If we simply do a Fibonacci retracement from the July 2019 high to the March 2020 low, we find that the next resistance is at $0.70, based on the 76.4% Fibonacci retracement level.

This is the same $0.70 price target we just established. We are therefore more confident that $0.70 is achievable based on the multiple Fibonacci projection technique.