Sands China Ltd. is a company that creates, owns, and runs integrated resorts, shopping malls, and casinos in China. Macau’s convention and exhibition halls are also managed by the company.

The Venetian Macao, Sands Macao, The Plaza Macao, The Londoner Macao, The Parisian Macao, ferry and other activities are the six parts that Sands China operates in Macau.

Gaming spaces, conference space, convention and exposition halls, retail and dining facilities, and entertainment venues are all part of the company’s operations.

Sands China Ltd maintained its good momentum in the three months ended June 30, 2021, with net revenues up 10.1 percent to US$849 million and Adjusted EBITDA up 32 percent to US$132 million, compared to the March quarter.

The results were also a stark contrast to the second quarter of 2020, when revenue from Macau operations hit a pitiful US$40 million in the midst of the COVID-19 outbreak. Although Sands China nevertheless lost US$166 million in the second quarter, it was a steady improvement from losses of US$549 million in the second quarter, US$562 million in the third quarter, US$246 million in the fourth quarter, and US$213 million in the first quarter.

The Venetian Macao, The Londoner Macao, The Parisian Macao, Sands Macao, and The Plaza Macao are all operated by Sands China.

LVS Chairman and CEO Robert Goldstein said, “We couldn’t be more excited about the possibility to welcome more guests back to our facilities when bigger quantities of people are eventually able to travel to Macau, Singapore, and Las Vegas.” “Demand for our offerings from those who have been allowed to visit continues to be strong, but pandemic-related travel restrictions, particularly in Macau and Singapore, continue to limit visitation and hampered our current financial performance… However, we are optimistic about the ultimate rebound in travel and tourist spending in all of our markets.

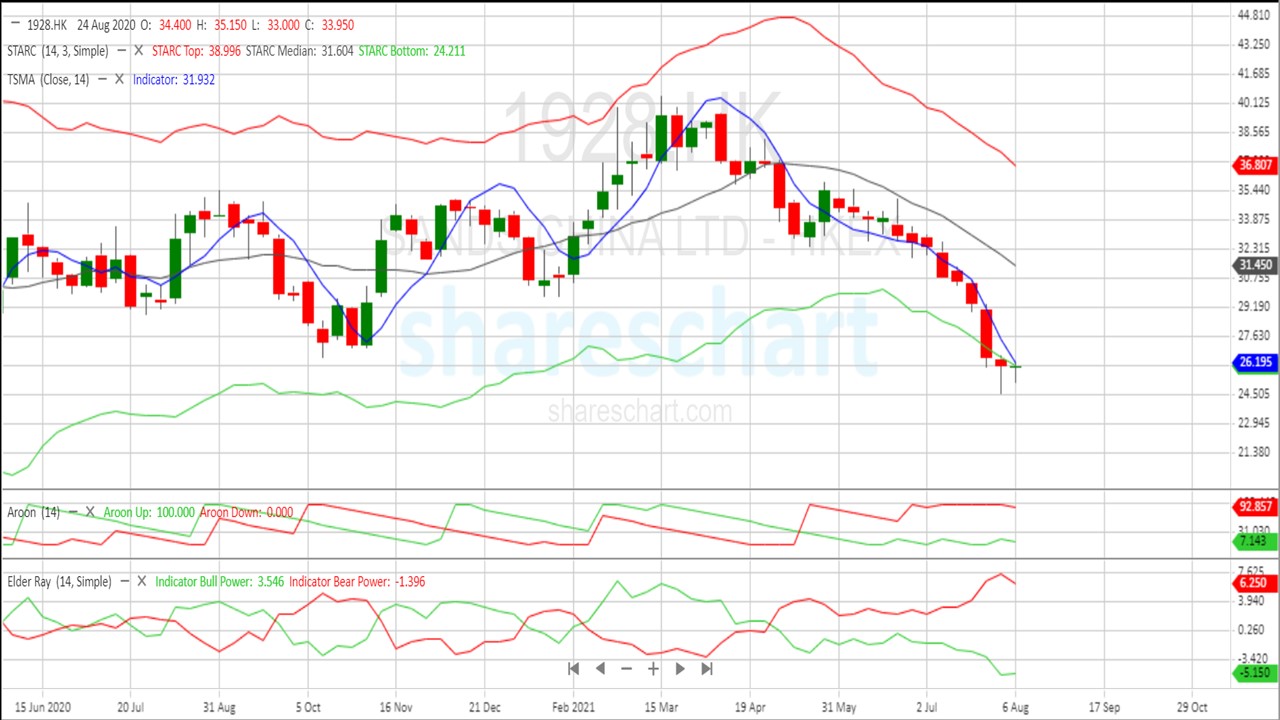

Sands China (1928.HK) hit a low of $24.55 and fell 16% in just 3 months. We believe the stock has bottomed and is poised for a rebound. The chart of Sands China shows an inverse “cup and handle” pattern that began in February of this year.

The price target of the “Inverse Cup and handle” pattern coincides with the recent 2 day’s low. The reading was taken at $40.55, the high of the chart pattern. The nice thing about trading chart patterns is that in most cases they show the exact price target. In this case, we are using the chart pattern to identify a reversal pattern rather than a continuation pattern. A reversal pattern allows traders to buy near the lowest price of a market trend.

Now let us take a close look at the indicators on the daily chart Sands China. Price crossed the lower band of the STARC indicator last week before re-entering the band. The TSM indicator has almost touched the lower band of the STARC indicator in the last few days. The two indicators show that the price of Sands China is oversold. Moreover, the positive and negative signals of the Aroon indicator and Elder Ray Indicator are relatively far apart. These two indicators show that the downtrend is overstretched and is likely to reverse.

If price bounces off its current level, the upside target is $30.66. This is based on the Fibonacci level measured from the recent high of $40.55.

Alternatively, if we assume a more recent high of $35.95, a 50% retracement also yields a price target of $30.25. This almost coincides with the $30.66 price target from our last reading. So, we believe the price target can be reached based on the double confirmation. Traders who buy now at the current price can make a whopping profit of around 6%.