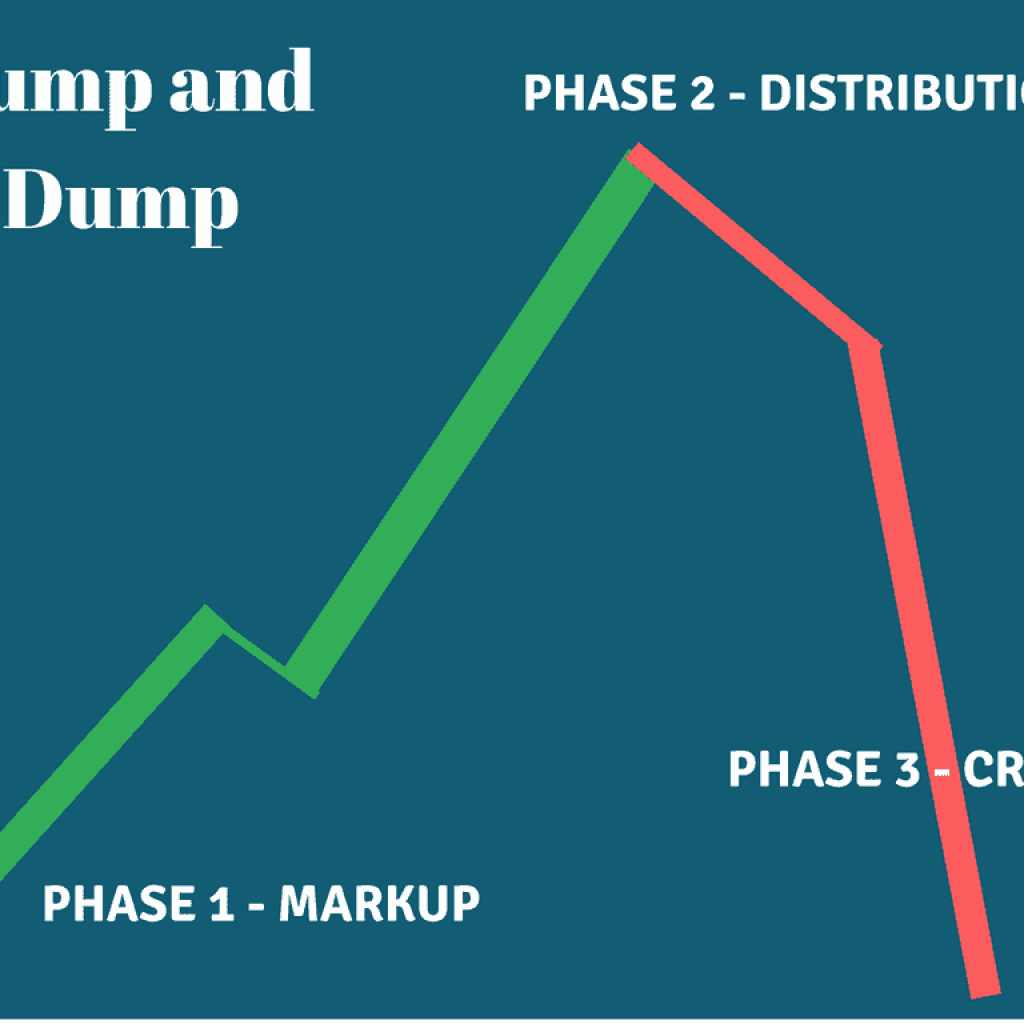

Pump and dump is a type of securities fraud in which an individual investor, an investment firm, or a corporation relentlessly promotes a stock they purchased at a low price, frequently based on misleading, inaccurate, or grossly inflated claims and facts, in order to increase the stock’s price.

By marketing the stock on social media sites, e-mails, newsletters, and online chat rooms and message boards, the fraudsters will inflate the stock’s price and persuade other buyers to buy it.

They will then sell their shares to new buyers who enter the market at a higher price, effectively leaving them with a worthless asset.

Cold calling used to be the method of choice for pump-and-dump schemes. However, since the internet’s invention, this unethical activity has become much more common. Fraudsters use social media to entice buyers to purchase a stock quickly by claiming to have inside information about a development that will result in a price increase. When investors come in, the criminals sell their shares, causing the price to plummet. The money of new investors is then lost.

Since micro- and small-cap stocks are the simplest to exploit, these strategies typically target them. Since these stocks have a small float, it only takes a few new investors to drive a stock higher.

An Introduction to Stock Promoters

Many micro and nano-cap companies lack the financial resources to maintain an in-house investor relations department, so they outsource the role to a specialist investor relations company. Answering investor inquiries, packaging financial details in an easy-to-digest format, and managing public relations are all typical tasks of an investor relations firm.

However, several IR companies operate as glorified stock marketing firms at the microcap stage. Rather than becoming an outsourced IR unit, they are hired by businesses looking to raise their stock price temporarily. The promoter is usually compensated in stock by the publicly listed company.

What would you do to prevent yourself from being trapped in a pump-and-dump situation?

Most importantly, you should use your own due diligence to buckle down and follow through on the hype. Make a list of basic questions about the company in question. Is it profitable for them? Is it true that they are developing new products? Are these new goods going to be worthwhile in the future? Trading Penny Stocks is similar to trading Crop Stocks in terms of its foundations. The costs, on the other hand, may be much greater, but the rewards will be identical.

Police Investigation ongoing

Recently, in the case of Singapore, The Commercial Affairs Department (“CAD”) has received concerns about alleged “pump and dump” schemes involving Hong Kong Stock Exchange firms. A “pump and dump” scheme is a form of stock market manipulation in which fraudsters artificially inflate a share’s price (“pumping”) before selling their own shares until the price rises (“dumping”). In order to persuade victims to trade in the company’s stock, the fraudsters “pump” up the share price using a number of tactics, such as distributing favorable yet misleading news about the company or generating a false perception of trading activity.

On social media sites like WeChat and LinkedIn, scammers pretending to be from China or Hong Kong approached victims. These con artists will then work patiently to earn the victims’ confidence by contacting them regularly under the guise of friendship or networking. After trust had been created, the scammers would reveal that they had insider information on some Hong Kong Stock Exchange companies. They will then persuade victims to purchase these shares by promising fast and certain gains.

Soon after the victims purchased their shares, the stock prices of these businesses plummeted, causing the victims to lose a significant amount of money.

To find out more, follow:

https://www.police.gov.sg/Media-Room/News/20190504_OTHERS_Police_Advisory_Pump_and_dump_scams_involving_Hong_Kong_listed_companies

Post Views:

860